Embark on a journey to learn How to Compare Life Insurance Quotes and Save Big with this insightful guide. Discover the key components of life insurance quotes, factors affecting premiums, and tips on comparing quotes effectively.

Understanding Life Insurance Quotes

Life insurance quotes are estimates provided by insurance companies that detail the cost and coverage options for a policy based on various factors. Understanding these quotes is crucial for selecting the right life insurance policy that suits your needs and budget.

Key Components of Life Insurance Quotes

- The premium: This is the amount you pay periodically to maintain the policy.

- The coverage amount: This is the sum of money that will be paid out to beneficiaries upon the policyholder's death.

- Policy details: This includes information on the type of policy, duration, and any additional riders or benefits.

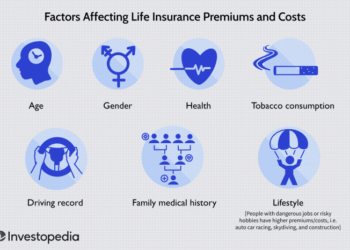

Factors Influencing Life Insurance Premiums

- Age: Younger individuals typically pay lower premiums as they are considered lower risk.

- Health: Your overall health and medical history can impact the cost of premiums.

- Lifestyle: Factors such as smoking, alcohol consumption, and participation in high-risk activities can affect premiums.

- Coverage amount: The higher the coverage amount, the higher the premium.

Importance of Comparing Quotes

- Cost savings: Comparing quotes allows you to find the most affordable policy that offers the coverage you need.

- Variety of options: Different insurance providers offer varying policy terms, benefits, and premiums, giving you a wider selection to choose from.

- Customization: By comparing quotes, you can tailor the policy to your specific needs and budget.

How to Compare Life Insurance Quotes

When looking to compare life insurance quotes, it's essential to follow a systematic approach to ensure you make an informed decision that meets your needs and budget. Here is a step-by-step guide on how to compare life insurance quotes effectively:

Step-by-Step Guide:

- Start by determining your coverage needs: Before comparing quotes, assess your financial obligations, such as outstanding debts, mortgage, education expenses, and future income needs. This will help you determine the appropriate coverage amount.

- Request quotes from multiple insurers: Obtain quotes from at least three different insurance companies to compare premiums and coverage options.

- Consider the coverage amounts and policy terms: Look beyond the premium amount and evaluate the coverage amounts, policy terms, and any additional benefits offered by each insurance provider.

- Review the policy features: Pay attention to the policy features, such as riders, exclusions, and limitations, to ensure the policy aligns with your needs and preferences.

- Evaluate the reputation and financial stability of insurance companies: Research the insurance companies' reputation, customer reviews, and financial strength ratings from agencies like AM Best, Moody's, or Standard & Poor's.

Significance of Comparing Coverage Amounts and Policy Terms:

- Comparing coverage amounts helps ensure that you select a policy that adequately protects your loved ones financially in case of your untimely demise.

- Evaluating policy terms is crucial to understand the duration of coverage, premium payment frequency, and any conditions that may affect the policy's benefits.

Tips on Evaluating the Reputation and Financial Stability of Insurance Companies:

- Check online reviews and ratings from reputable sources to gauge customer satisfaction and service quality.

- Verify the financial strength of insurance companies by reviewing their ratings from independent rating agencies.

- Consider the company's claims processing history and responsiveness to customer inquiries and concerns.

Saving Money on Life Insurance

When it comes to purchasing life insurance, saving money is always a priority for many individuals. There are several strategies you can implement to ensure you are getting the best value for your money.

Comparing Term Life Insurance and Whole Life Insurance

When looking at cost-effectiveness, term life insurance typically offers more affordable premiums compared to whole life insurance. Term life insurance provides coverage for a specific period, such as 10, 20, or 30 years, making it a more budget-friendly option for many individuals.

On the other hand, whole life insurance offers coverage for your entire life and includes a cash value component, but it comes with higher premiums.

Bundling Insurance Policies

One effective strategy for saving money on life insurance is bundling your insurance policies. By combining your life insurance policy with other insurance products like auto or home insurance, many insurance companies offer discounts on premiums. This bundling not only saves you money but also simplifies the management of your insurance policies.

Utilizing Online Tools for Comparison

When it comes to comparing life insurance quotes, utilizing online tools can make the process much easier and more efficient. Online platforms offer a wide range of resources that can help you find the best deals and make informed decisions about your coverage.

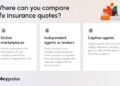

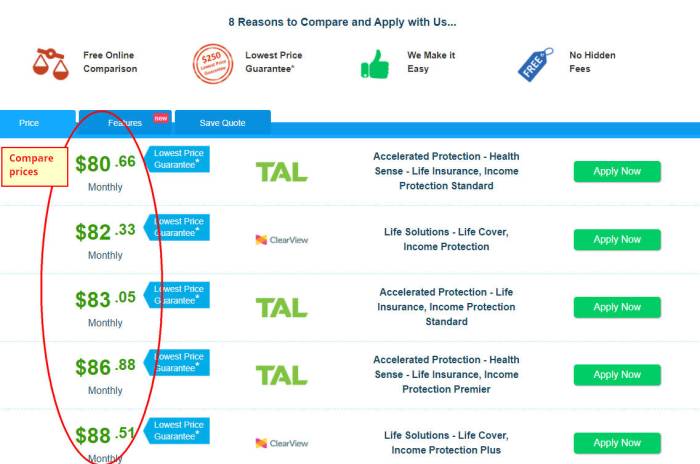

Online Comparison Platforms

Online comparison platforms allow you to compare multiple life insurance quotes from different providers in one place. This saves you time and effort by eliminating the need to visit individual websites or contact insurance agents separately.

- Access to Multiple Quotes: Online tools provide access to a variety of life insurance quotes, allowing you to compare premiums, coverage options, and benefits side by side.

- Transparent Information: These platforms offer transparent information about each policy, making it easier to understand the terms and conditions before making a decision.

- Saves Time and Money: By using online comparison tools, you can quickly identify the best deals and potentially save money on your life insurance policy.

Using Online Calculators

Online calculators can help you estimate your insurance needs and premiums based on your personal information and financial situation. Here are some tips on how to effectively use online calculators:

- Provide Accurate Information: Input accurate details about your age, health, income, and financial goals to get a more precise estimate of your insurance needs.

- Compare Different Scenarios: Use the calculator to compare different coverage amounts and policy types to see how they impact your premiums and benefits.

- Review Regularly: It's essential to review your insurance needs and premiums regularly, especially when your financial situation or life circumstances change.

Concluding Remarks

In conclusion, mastering the art of comparing life insurance quotes can lead to significant savings. By understanding the nuances of coverage amounts, policy terms, and utilizing online tools, you can make informed decisions to secure your financial future.

FAQ Guide

How can I save money on life insurance?

Exploring term life insurance, whole life insurance, and bundling policies are effective strategies for saving money on life insurance.

Why is it important to compare life insurance quotes from different providers?

Comparing quotes helps you find the best coverage at the most competitive rates, ensuring you save big on your life insurance policy.

What are some online tools for comparing life insurance quotes?

Online comparison platforms and calculators can be used to compare quotes, estimate insurance needs, and find the best deals available.