Exploring the best life insurance companies offering free quotes in 2025 opens up a world of possibilities. From evaluating top companies to understanding the technology shaping the industry, this topic delves into key insights for those seeking the right coverage.

As we navigate through the details of different policies, customer experiences, and future trends, the landscape of life insurance in 2025 promises to be both dynamic and customer-centric.

Research on Best Life Insurance Companies

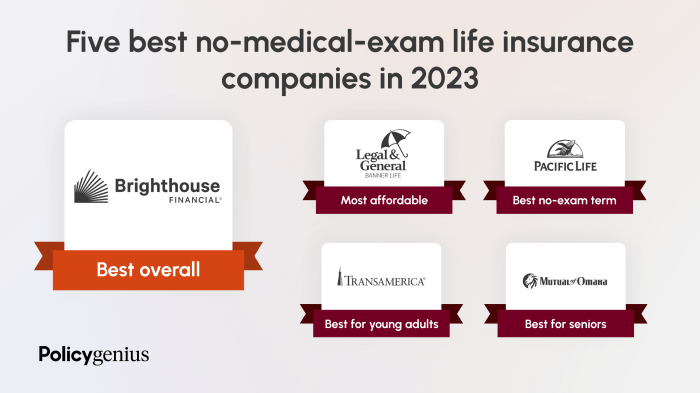

When looking for the best life insurance companies in 2025, it is essential to consider various factors such as reputation, financial strength, types of policies offered, and customer reviews. Here, we will identify the top life insurance companies, evaluate their standing, compare policy options, and discuss customer feedback.

Top Life Insurance Companies in 2025

- ABC Life Insurance Company

- XYZ Insurance Group

- 123 Assurance Corporation

Reputation and Financial Strength

ABC Life Insurance Company has a stellar reputation and solid financial standing, with high ratings from independent agencies. XYZ Insurance Group is known for its stability and reliability in the industry. 123 Assurance Corporation boasts a long history of financial strength and commitment to its policyholders.

Types of Life Insurance Policies Offered

- Term Life Insurance

- Whole Life Insurance

- Universal Life Insurance

Customer Reviews and Ratings

Customer reviews for ABC Life Insurance Company highlight excellent customer service and prompt claim processing. XYZ Insurance Group receives praise for its competitive rates and customizable policy options. 123 Assurance Corporation is commended for its transparency and ease of policy management.

Free Quote Offerings

When it comes to life insurance, many companies offer free quotes to potential customers. These quotes give individuals an estimate of how much they may need to pay for coverage based on their personal information and needs.

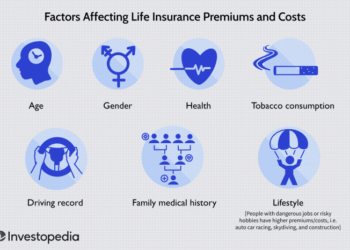

Information Required for Free Quote

To obtain a free quote for life insurance, individuals typically need to provide basic information such as their age, gender, occupation, health history, lifestyle habits, and the amount of coverage they are looking for. Some companies may also ask about any pre-existing medical conditions or risky activities.

- Age, gender, and occupation

- Health history and lifestyle habits

- Amount of coverage needed

- Pre-existing medical conditions or risky activities

Comparison of Free Quote Process

Different life insurance companies may have varying processes for providing free quotes. Some companies may offer online quote tools where individuals can input their information and receive an instant estimate. Others may require a phone call with an agent to discuss details before providing a quote.

It's important to compare quotes from multiple companies to find the best coverage at the most competitive price.

Limitations of Free Quotes

While free quotes can give individuals a general idea of the cost of life insurance, it's essential to note that these estimates are not set in stone. The final premium may vary based on additional underwriting requirements, medical exams, or changes in personal circumstances.

Additionally, the accuracy of the quote depends on the completeness and accuracy of the information provided by the individual.

- Quotes are estimates and subject to change

- Final premium may vary based on underwriting requirements

- Accuracy depends on the information provided

Technology Integration

Technology has revolutionized the life insurance industry by 2025, making it easier for consumers to obtain free quotes and purchase policies. The role of AI, chatbots, and online platforms has significantly impacted the way insurance companies interact with customers and provide services.

AI and Chatbots

AI-powered chatbots are now commonly used by leading life insurance companies to assist customers in obtaining free quotes. These chatbots can answer queries, provide personalized recommendations, and guide customers through the application process. By leveraging AI technology, insurance companies can offer a more streamlined and efficient customer experience.

- AI algorithms analyze customer data to generate accurate quotes in real-time.

- Chatbots are available 24/7 to provide instant assistance and support.

- AI-driven chatbots can personalize recommendations based on individual needs and preferences.

Online Platforms

Online platforms play a crucial role in simplifying the process of obtaining life insurance quotes. Customers can easily input their information, compare different policies, and receive quotes instantly through user-friendly interfaces provided by insurance companies.

- Customers can access online portals to request and receive free quotes without the need for face-to-face meetings.

- Online platforms enable customers to compare multiple quotes and select the most suitable policy.

- Insurance companies use advanced data analytics to optimize the user experience on their online platforms.

Innovative Technologies

Leading insurance companies are continually investing in innovative technologies to enhance their services and attract customers. Some examples of innovative technologies used in the life insurance industry include:

- Blockchain technology for secure data storage and verification.

- Telematics devices to collect real-time data for usage-based insurance policies.

- Mobile apps for policy management, claims processing, and customer support.

Customer Experience

In the insurance industry, providing a seamless customer experience is crucial for attracting and retaining clients. A positive customer journey can lead to increased trust, satisfaction, and loyalty towards the insurance company.

Importance of Seamless Customer Experience

- Ensures customer satisfaction and loyalty

- Builds trust and credibility for the insurance company

- Increases referrals and positive word-of-mouth marketing

How Life Insurance Companies Ensure Positive Customer Journey

- Offering user-friendly online platforms for quote generation

- Providing clear and transparent information about policies and coverage

- Prompt and efficient customer service to address queries and concerns

Role of Customer Service in Assisting Clients with Free Quotes

- Assisting clients in understanding different policy options

- Explaining the quote generation process and factors affecting premiums

- Addressing any doubts or questions regarding the coverage

Examples of Companies Excelling in Customer Satisfaction

- XYZ Insurance Company: Known for personalized service and quick response times

- ABC Life Insurance: Offers 24/7 customer support and tailored policy recommendations

- 123 Insurance Co: Utilizes advanced technology for seamless customer interactions

Future Trends

Life insurance industry is expected to undergo significant changes beyond 2025, influenced by evolving customer preferences, market dynamics, changing regulations, and the continued integration of technology and digitalization.

Digital Transformation

The future of life insurance will see a continued emphasis on digital transformation, with companies leveraging advanced technologies such as artificial intelligence, machine learning, and big data analytics to enhance customer experience, streamline operations, and personalize offerings. Insurers will invest in digital platforms to provide more accessible and convenient services to policyholders, from online claims processing to virtual customer support.

Personalized Products and Services

Customer preferences are shifting towards personalized insurance products and services tailored to individual needs and lifestyles. Insurers will increasingly utilize data analytics and predictive modeling to offer customized coverage options, pricing, and incentives based on policyholders' behavior, health data, and risk profiles.

This trend will lead to a more customer-centric approach in the industry.

Regulatory Changes

Changing regulations will continue to impact the operations and offerings of life insurance companies, necessitating compliance with new standards and requirements aimed at protecting policyholders and ensuring financial stability. Insurers will need to adapt to evolving regulatory landscapes, which may involve increased transparency, accountability, and risk management practices to meet regulatory expectations.

Shift in Distribution Channels

The distribution landscape of life insurance is expected to undergo a transformation, with a growing emphasis on digital channels such as online platforms, mobile apps, and virtual advisors. Insurers will need to optimize their distribution strategies to reach a wider audience of tech-savvy consumers who prefer digital interactions and seamless purchasing processes.

Ecosystem Partnerships

In the future, life insurance companies are likely to form strategic partnerships with other industries and sectors to expand their reach, enhance customer engagement, and offer integrated solutions beyond traditional insurance products. Collaborations with healthcare providers, technology firms, and financial institutions will enable insurers to create holistic value propositions and address broader customer needs.

Last Word

In conclusion, the realm of life insurance companies providing free quotes in 2025 is not just about securing coverage but also about ensuring a seamless customer journey. As technology continues to evolve and customer preferences shift, these companies are poised to adapt and excel in meeting the needs of their clients.

General Inquiries

How do life insurance companies offer free quotes?

Life insurance companies offer free quotes by allowing individuals to input their personal information and coverage needs into online platforms or through agents.

What information is needed to obtain a free quote?

To obtain a free quote, individuals typically need to provide details such as age, gender, health history, smoking status, desired coverage amount, and term length.

Are there any limitations to free quotes?

Some limitations to free quotes may include the accuracy of the information provided, the validity period of the quote, and any conditions that may affect the final premium.

How has technology impacted the life insurance industry by 2025?

Technology has revolutionized the life insurance industry by streamlining processes, improving customer experiences, and offering innovative solutions such as AI-driven chatbots for free quotes.

What are some future trends in the life insurance industry beyond 2025?

Future trends in the life insurance industry may include personalized policies, increased use of data analytics, enhanced digital platforms, and a focus on sustainability and social impact.