Starting off with Life Insurance Quote for Seniors: What You Need to KnowThe Role of Conversational AI in Telemedicine and Virtual Care, this introductory paragraph aims to grab the attention of the readers, setting the stage for an informative discussion ahead.

The following paragraph will delve into the details and nuances of the topic at hand

Life Insurance Quote for Seniors

Life insurance is crucial for seniors as it provides financial protection for their loved ones in the event of their passing. It can help cover funeral expenses, outstanding debts, and provide a source of income for beneficiaries.

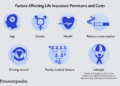

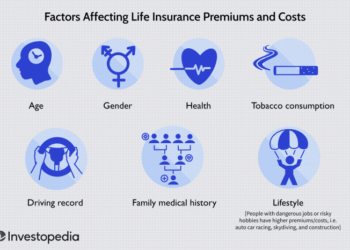

Key Factors Affecting Life Insurance Quotes for Seniors

- Age: The older you are, the higher your premium is likely to be.

- Health: Pre-existing medical conditions can impact the cost of your life insurance.

- Coverage amount: The more coverage you need, the higher your premium will be.

- Smoking status: Smokers typically pay higher premiums than non-smokers.

Tips for Seniors to Obtain the Best Life Insurance Quotes

- Shop around and compare quotes from multiple insurance providers.

- Maintain a healthy lifestyle to potentially lower your premium.

- Consider a term life insurance policy for more affordable coverage.

- Work with an independent insurance agent who can help you find the best rates.

Types of Life Insurance Policies Available for Seniors

- Term life insurance: Provides coverage for a specific period of time.

- Whole life insurance: Offers lifelong coverage with a cash value component.

- Guaranteed issue life insurance: No medical exam required, but premiums are typically higher.

What You Need to Know About Life Insurance

Life insurance is a contract between an individual and an insurance company where the individual pays premiums in exchange for a lump sum payment to beneficiaries upon the insured individual's death. It provides financial protection and peace of mind to loved ones in the event of the insured's passing.

Benefits of Having Life Insurance for Seniors

- Financial security for dependents: Life insurance ensures that seniors can leave behind a financial safety net for their loved ones, covering expenses such as mortgage payments, debts, and daily living costs.

- Estate planning: Seniors can use life insurance to help with estate planning by providing funds to pay estate taxes and other expenses, ensuring that their assets are transferred smoothly to beneficiaries.

- Funeral and final expenses: Life insurance can help cover funeral and burial costs, relieving financial burden on family members during a difficult time.

Scenarios Where Life Insurance Can be Beneficial for Seniors

- Seniors with dependents: For seniors who have children or other dependents relying on them financially, life insurance can ensure that their loved ones are taken care of even after they are gone.

- Business owners: Seniors who own businesses can use life insurance to provide funds for business continuation or buyout arrangements, protecting their business interests and partners.

- Charitable giving: Seniors who wish to leave a legacy or support charitable causes can use life insurance as a way to make a significant impact even after their passing.

Term Life Insurance vs. Whole Life Insurance for Seniors

- Term life insurance: Provides coverage for a specific period (term) and is typically more affordable for seniors. It offers a death benefit if the insured passes away during the term but doesn't accumulate cash value.

- Whole life insurance: Offers lifelong coverage with a cash value component that grows over time. While more expensive, whole life insurance can provide a guaranteed death benefit and potential cash value accumulation for seniors.

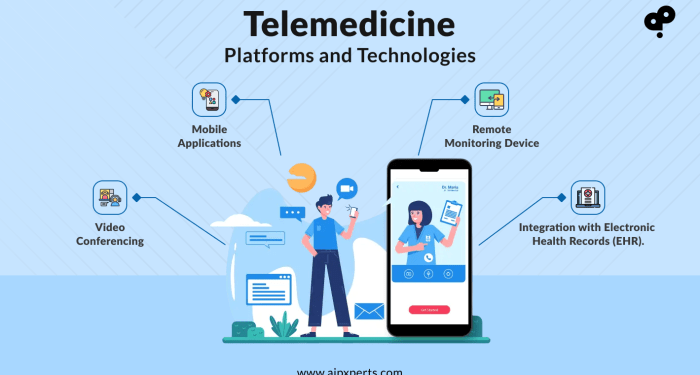

The Role of Conversational AI in Telemedicine

Conversational AI is revolutionizing the field of telemedicine by providing advanced communication tools that enable healthcare providers to interact with patients remotely

Advantages of Using Conversational AI in Telemedicine for Seniors

- Improved Access to Healthcare: Seniors in remote or rural areas can easily connect with healthcare providers through conversational AI, eliminating the need for travel.

- Enhanced Patient Engagement: AI chatbots can engage seniors in conversations about their health, medication reminders, and lifestyle choices, promoting better health outcomes.

- 24/7 Availability: Seniors can access medical advice and assistance at any time of the day, reducing the need for emergency room visits.

Examples of How Conversational AI Can Improve Patient Care in Virtual Settings

- Virtual Triage: AI-powered chatbots can assess symptoms, provide initial diagnosis, and recommend the appropriate level of care for seniors, streamlining the triage process.

- Medication Management: AI platforms can remind seniors to take their medications on time, track adherence, and alert healthcare providers in case of missed doses.

- Remote Monitoring: AI algorithms can analyze data from wearable devices to monitor vital signs, detect anomalies, and alert healthcare providers of potential health risks.

Challenges and Limitations of Implementing Conversational AI in Telemedicine

- Privacy Concerns: Ensuring the security and confidentiality of patient information during AI interactions poses a significant challenge for healthcare providers.

- Accuracy and Reliability: AI chatbots may provide incorrect information or recommendations, leading to potential misdiagnosis or inappropriate treatment plans.

- User Acceptance: Some seniors may feel uncomfortable or hesitant to interact with AI technology, leading to resistance in adopting telemedicine solutions.

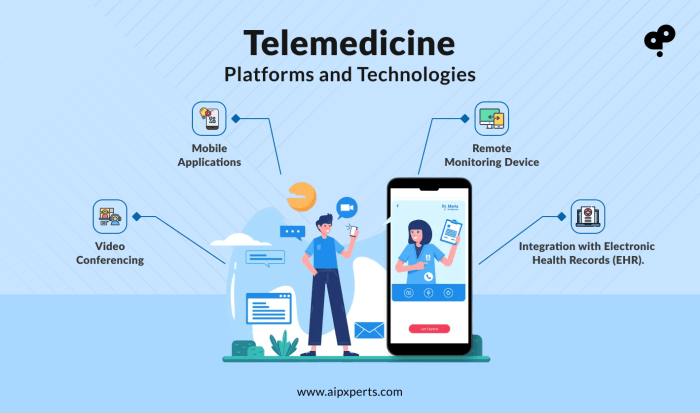

Virtual Care for Seniors

Virtual care refers to the use of telecommunication technology to provide healthcare services remotely, allowing seniors to access medical assistance without the need to physically visit a healthcare facility. This concept is especially relevant for seniors who may have mobility issues or live in remote areas where access to healthcare services is limited.

The Benefits of Virtual Care for Seniors

- Convenience: Seniors can consult with healthcare providers from the comfort of their homes, eliminating the need for travel.

- Accessibility: Virtual care allows seniors to access healthcare services regardless of their location, improving healthcare equity.

- Cost-effective: Virtual care can reduce healthcare costs for seniors by minimizing transportation expenses and hospital visits.

Best Practices for Implementing Virtual Care Strategies for Seniors

- Provide user-friendly technology: Ensure that virtual care platforms are easy to navigate for seniors, considering their technological proficiency.

- Offer support: Provide training and assistance to seniors to help them feel comfortable using virtual care services.

- Ensure privacy and security: Implement robust data protection measures to safeguard seniors' personal health information.

The Role of Telehealth Platforms in Delivering Virtual Care to Seniors

- Telehealth platforms play a crucial role in connecting seniors with healthcare providers through video calls, messaging, and remote monitoring.

- These platforms enable seniors to schedule appointments, access medical records, and receive follow-up care without leaving their homes.

- Telehealth platforms ensure continuity of care for seniors, promoting better health outcomes and quality of life.

Concluding Remarks

Wrapping up with a compelling summary that encapsulates the key points of our discussion

Q&A

What factors affect life insurance quotes for seniors?

Factors such as age, health condition, coverage amount, and type of policy can influence life insurance quotes for seniors.

How is conversational AI transforming telemedicine?

Conversational AI is enhancing telemedicine by enabling automated interactions, improving patient engagement, and streamlining healthcare processes.

What are the benefits of virtual care for seniors?

Virtual care offers seniors increased access to healthcare, convenience, reduced travel, and the ability to monitor their health remotely.