Exploring the process of obtaining instant life insurance quotes online can be both enlightening and empowering. From understanding the importance of research to navigating through the various types of policies, this guide will walk you through the essentials of securing the right coverage conveniently and efficiently.

As we delve deeper into the intricacies of instant life insurance quotes, you'll gain valuable insights that will aid you in making informed decisions about your financial future.

Researching Life Insurance Quotes Online

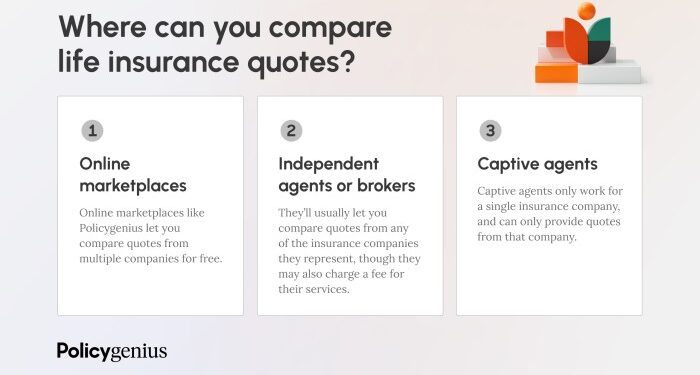

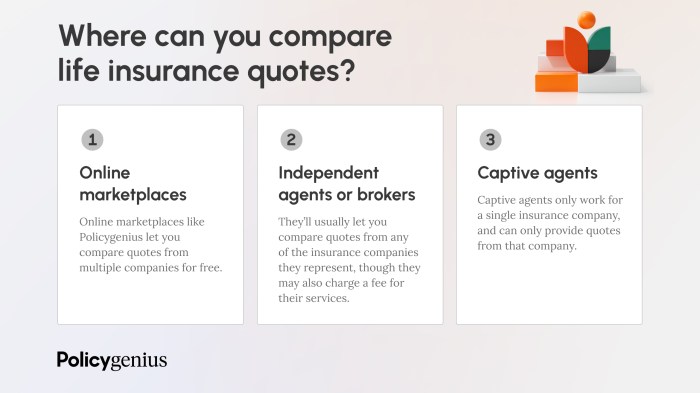

When it comes to purchasing life insurance, researching multiple quotes online is crucial to ensure you find the best coverage at the most affordable rates. By comparing instant life insurance quotes from different providers, you can make an informed decision that meets your needs and budget.

Key Factors to Consider When Comparing Instant Life Insurance Quotes Online

- Coverage Amount: Determine the amount of coverage you need based on your financial obligations and future goals.

- Premiums: Compare the premiums offered by different insurance companies to find the most competitive rates.

- Policy Terms: Understand the terms and conditions of each policy, including the length of coverage and any exclusions.

- Financial Strength: Look into the financial stability of the insurance company to ensure they can fulfill their obligations in the future.

- Customer Reviews: Check reviews and ratings of the insurance providers to gauge their customer service and satisfaction levels.

Benefits of Using Online Tools to Obtain Life Insurance Quotes Instantly

- Convenience: Instant life insurance quotes can be obtained from the comfort of your home, saving you time and effort.

- Comparison: Online tools allow you to compare multiple quotes side by side, helping you make an informed decision.

- Transparency: You can easily see the details of each policy, including coverage amounts, premiums, and terms, to make a well-informed choice.

- Speed: Instant quotes provide quick access to pricing information, allowing you to make timely decisions about your life insurance needs.

Understanding Instant Life Insurance Quotes

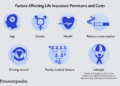

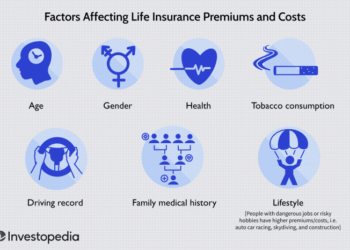

When it comes to getting instant life insurance quotes online, the process is quick and convenient. By providing some basic information such as age, gender, coverage amount, and health status, you can receive multiple quotes from different insurance companies within minutes.

This allows you to compare rates and coverage options easily without the need for lengthy phone calls or in-person meetings.

Types of Life Insurance Policies Available for Instant Quotes

- Term Life Insurance: Provides coverage for a specific period, typically 10, 20, or 30 years.

- Whole Life Insurance: Offers coverage for your entire life and includes a cash value component.

- Universal Life Insurance: Flexible policy that allows you to adjust premiums and coverage amounts.

Comparison of Obtaining Instant Life Insurance Quotes Online vs. Traditional Methods

- Online:Instantly compare rates from multiple insurance companies, convenient and fast process, no need for face-to-face meetings.

- Traditional:Requires scheduling appointments with agents, longer processing time, limited options for comparison.

Using Online Quote Tools

When it comes to getting an instant life insurance quote online, utilizing online tools can be a convenient and efficient way to quickly gather information. These tools are designed to streamline the process and provide you with an estimate of the cost of life insurance based on your personal details.

Steps Involved in Using Online Quote Tools

- Visit a reputable life insurance website that offers an online quote tool.

- Enter your basic information, such as age, gender, height, weight, and smoking status.

- Provide details about the coverage you are looking for, such as the desired policy amount and term length.

- Submit the information and wait for the tool to generate an instant life insurance quote for you.

Information Required for an Accurate Life Insurance Quote Online

- Your age: This is a crucial factor in determining your life insurance premium.

- Health information: Details about your health history, including any pre-existing conditions or medications you take.

- Lifestyle habits: Information about whether you smoke or engage in any high-risk activities.

- Policy details: The amount of coverage you need and the term length you are interested in.

Tips to Ensure the Accuracy of the Instant Life Insurance Quote

- Provide accurate information: Be honest and upfront about your personal details to receive a realistic quote.

- Compare quotes: Utilize multiple online tools to get quotes from different insurance providers for a comprehensive comparison.

- Consult with an expert: If you have any questions or concerns, consider reaching out to a life insurance agent for guidance.

Comparing Quotes and Selecting the Right Policy

When it comes to choosing the right life insurance policy, comparing quotes online is a crucial step in finding the best coverage that suits your needs and budget. By evaluating different instant life insurance quotes, you can make an informed decision that provides the necessary financial protection for you and your loved ones.

Factors to Consider When Selecting the Right Life Insurance Policy

- Coverage Amount: Determine the amount of coverage you need based on your financial obligations, such as mortgage, debts, and future expenses.

- Term Length: Choose between term life insurance for a specific period or whole life insurance for lifelong coverage.

- Premium Costs: Compare premium rates from different insurance companies to find an affordable policy within your budget.

- Financial Stability of the Insurance Company: Research the financial ratings of insurance providers to ensure they can fulfill their obligations in the future.

- Riders and Additional Benefits: Look for optional riders or benefits that can enhance your policy, such as critical illness coverage or accidental death benefits.

Reading the Terms and Conditions Carefully

Before finalizing a life insurance policy online, it is essential to read the terms and conditions carefully to understand the coverage, exclusions, limitations, and any additional requirements. Pay attention to details such as premium payment frequency, policy renewal options, beneficiary designations, and claim procedures.

By reviewing the policy thoroughly, you can avoid any surprises or misunderstandings in the future.

Final Conclusion

In conclusion, mastering the art of obtaining instant life insurance quotes online opens doors to a world of possibilities for safeguarding your loved ones and securing peace of mind. By following the Artikeld steps and utilizing the provided tools, you are well-equipped to make sound choices regarding your life insurance needs.

FAQ Overview

What factors should I consider when comparing instant life insurance quotes online?

When comparing quotes online, it's crucial to assess the coverage amount, premium rates, policy terms, and the reputation of the insurance provider.

What information is typically required to receive an accurate life insurance quote online?

To obtain an accurate quote, you'll likely need to provide details such as your age, gender, health history, lifestyle habits, and desired coverage amount.

How do I ensure the accuracy of the instant life insurance quote obtained online?

To ensure accuracy, double-check the information you provide, review the policy details thoroughly, and seek clarification from the insurance provider if needed.