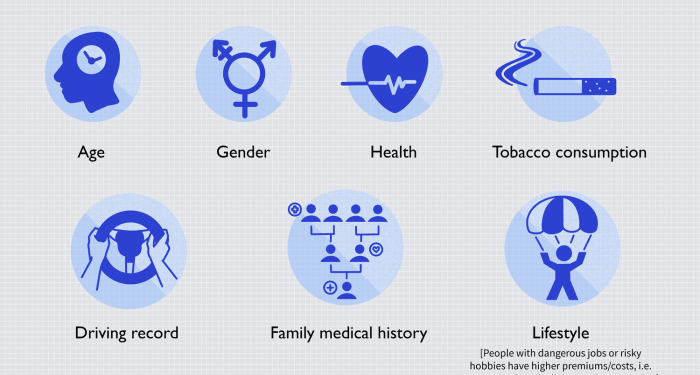

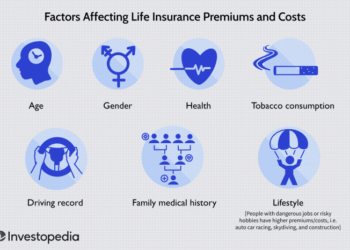

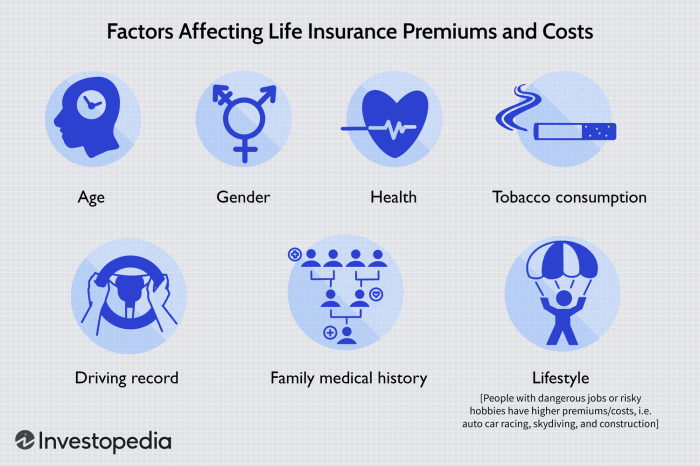

Delving into the world of life insurance quotes, we uncover the key factors that play a pivotal role in determining your coverage costs. From age to lifestyle choices, each aspect influences the final numbers you see. Let's explore the intricacies of what truly impacts your life insurance premiums.

Factors Affecting Life Insurance Quotes

When it comes to determining life insurance quotes, several key factors play a significant role in shaping the premiums that individuals are required to pay. Understanding these factors is crucial for anyone looking to secure the right coverage at a reasonable cost.

Age Impact on Life Insurance Quotes

Age is one of the most critical factors that influence life insurance quotes. Generally, younger individuals are offered lower premiums as they are considered to be at lower risk of developing health issues or facing mortality. As individuals age, the likelihood of health complications increases, leading to higher insurance rates.

This is why it is often recommended to purchase life insurance at a younger age to lock in lower premiums.

Health and Lifestyle Choices on Insurance Premiums

Health and lifestyle choices also play a significant role in determining life insurance quotes. Insurers assess the overall health of an individual, including factors such as pre-existing medical conditions, BMI, and smoking habits. Those who maintain a healthy lifestyle and have no underlying health issues are likely to receive more affordable insurance rates.

On the other hand, individuals with poor health or risky habits may face higher premiums to offset the increased risk they pose to the insurer.

Coverage Amount Influence on Insurance Quote

The coverage amount selected by an individual also impacts the life insurance quote they receive. Higher coverage amounts typically result in higher premiums, as the insurer is taking on a greater financial risk by providing a larger payout in the event of the policyholder's death.

It is essential to strike a balance between the desired coverage amount and the premiums one can comfortably afford to ensure adequate protection without overpaying for unnecessary coverage.

Influence of Medical History

Having a detailed medical history can significantly impact the cost of your life insurance policy. Insurance companies consider pre-existing conditions, family medical history, and overall health when determining your premiums.

Pre-existing Conditions

- Chronic illnesses such as diabetes, heart disease, cancer, or mental health disorders can lead to higher premiums.

- Conditions like high blood pressure or cholesterol may also affect your rates.

- Smoking, obesity, and substance abuse can increase the cost of your life insurance.

Family Medical History

- If your immediate family members have a history of serious illnesses or genetic conditions, it may impact your premiums.

- Insurance companies assess the risk of hereditary diseases when determining your life insurance rates.

- A positive family medical history with no significant health issues can potentially lower your insurance costs.

Lifestyle Choices and Habits

Smoking, alcohol consumption, occupation, hobbies, and risky behaviors all play a significant role in determining life insurance quotes. Insurers take these lifestyle choices and habits into consideration when assessing the risk associated with providing coverage to an individual.

Impact of Smoking and Alcohol Consumption

- Smoking: Smokers generally have higher life insurance premiums due to the increased health risks associated with smoking. This habit can lead to various health issues such as cancer, heart disease, and respiratory problems, making smokers a higher risk for insurers.

- Alcohol Consumption: Excessive alcohol consumption can also impact life insurance rates. Individuals who consume alcohol excessively are at a higher risk of developing liver disease, heart conditions, and other health issues, leading to higher premiums.

Role of Occupation and Hobbies

- Occupation: Certain occupations that involve high-risk environments or hazardous conditions may result in higher life insurance premiums. Jobs in industries like mining, construction, and law enforcement are often classified as high-risk by insurers.

- Hobbies: Engaging in high-risk hobbies such as skydiving, scuba diving, or racing can also impact life insurance rates. Insurers consider these activities as potential risks that could lead to accidents or injuries, affecting the overall insurance premium.

Effect of Risky Behaviors like Extreme Sports

- Extreme sports: Participating in extreme sports such as rock climbing, bungee jumping, or base jumping may increase life insurance premiums. These activities are considered high-risk and can lead to serious injuries or even death, resulting in insurers charging higher rates to cover the associated risks.

Geographic Location and Environmental Factors

When it comes to life insurance quotes, your geographic location and environmental factors play a significant role in determining the premiums you will pay. Let's delve into how these factors can impact your life insurance costs.

Impact of Urban vs. Rural Areas

One key aspect that influences life insurance quotes is whether you live in an urban or rural area. Typically, individuals residing in urban areas may face higher premiums due to factors such as higher crime rates, increased traffic accidents, and greater exposure to pollution.

Environmental Risks and Natural Disasters

Environmental risks, such as the likelihood of natural disasters in your area, can also affect your life insurance premiums. If you reside in a region prone to hurricanes, earthquakes, or wildfires, insurance companies may charge higher rates to account for the increased risk of potential claims.

Impact of Crime Rates

The crime rate in your area can have a direct impact on your life insurance costs. Higher crime rates often correlate with greater risks of theft, vandalism, or even violent crimes, leading insurance providers to adjust premiums accordingly to mitigate potential financial losses.

Policy Type and Duration

Choosing the right type of life insurance policy and determining the duration of coverage are crucial factors that significantly impact your insurance quote.

Policy Type and Insurance Quote

Different types of life insurance policies, such as term life, whole life, and universal life, come with varying premium rates. Term life insurance, which provides coverage for a specific period, typically offers lower premiums compared to whole life or universal life policies.

This is because term life insurance does not include a cash value component and is considered more affordable for the coverage it provides.

- Term Life Insurance: Offers coverage for a specific term and tends to have lower premiums.

- Whole Life Insurance: Provides coverage for the insured's entire life and includes a cash value component, resulting in higher premiums.

- Universal Life Insurance: Offers flexibility in premium payments and coverage but may have varying premium rates based on market conditions.

Duration of Policy Term and Premium Amount

The duration of the policy term also plays a significant role in determining the premium amount. Generally, longer policy terms result in higher premiums due to the increased risk exposure over an extended period. On the other hand, shorter policy terms, such as 10 or 20 years, may have lower premiums but offer coverage for a limited period.

Keep in mind that the longer you choose to be covered, the higher the premium you may have to pay.

- Short-Term Policies: Offer coverage for a specific period, like 10 or 20 years, with lower premiums.

- Long-Term Policies: Provide coverage for the insured's lifetime or extended periods, resulting in higher premiums.

Ending Remarks

In conclusion, the myriad factors discussed shed light on the complex nature of life insurance quotes. By understanding these key elements, you can make informed decisions when securing your financial future.

Questions Often Asked

How does age affect life insurance quotes?

Age plays a significant role in life insurance premiums, with younger individuals typically receiving lower quotes compared to older applicants.

What impact does smoking have on life insurance quotes?

Smoking can lead to higher insurance costs due to the associated health risks, making it a key factor in determining your life insurance quote.

Does family medical history affect life insurance premiums?

Yes, family medical history can influence your life insurance costs, especially if there is a history of hereditary diseases or conditions.