Exploring the debate between Term vs Whole Life Insurance Quotes: Which Is Better for You?, this introduction sets the stage for a comprehensive analysis, blending engaging insights with informative details to captivate readers right from the start.

Providing a detailed overview of the topic in a structured and engaging manner

Term Life Insurance

Term life insurance is a type of life insurance that provides coverage for a specific period, typically ranging from 10 to 30 years. It offers a death benefit to the beneficiaries if the policyholder passes away during the term of the policy.

Advantages of Term Life Insurance

- Cost-effective premiums compared to whole life insurance.

- Flexibility to choose the coverage term based on individual needs.

- Simple and straightforward coverage without cash value accumulation.

Disadvantages of Term Life Insurance

- Does not offer cash value or investment component like whole life insurance.

- Premiums may increase significantly when renewing after the initial term.

- No benefits if the policyholder outlives the term of the policy.

Whole Life Insurance

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured individual, as long as premiums are paid. Unlike term life insurance, which only covers a specific period, whole life insurance offers a death benefit along with a cash value component that grows over time.

Examples of Whole Life Insurance Quotes

- Male, 30 years old, non-smoker: $500,000 coverage - $300 monthly premium

- Female, 45 years old, non-smoker: $250,000 coverage - $400 monthly premium

- Male, 50 years old, smoker: $100,000 coverage - $600 monthly premium

Benefits and Drawbacks of Whole Life Insurance

Whole life insurance offers several benefits, including:

- Permanent coverage for life

- Accumulation of cash value over time

- Option to take out loans against the cash value

- Stable premiums that do not increase with age

However, there are also drawbacks to consider:

- Higher premiums compared to term life insurance

- Complexity in understanding the policy and its components

- Lower returns on the cash value compared to other investment options

- May not be the most cost-effective option for everyone

Factors to Consider

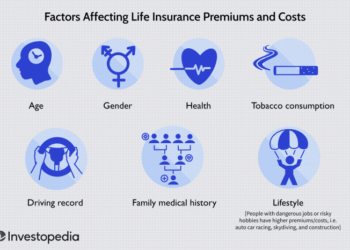

When choosing between term and whole life insurance, there are several key factors that individuals should take into consideration to make an informed decision. Factors such as age, health, and coverage duration play a crucial role in determining which type of insurance is better suited for your needs.

Age and Health

Age and health are significant factors that can impact insurance quotes for both term and whole life insurance. Younger individuals typically receive lower premiums for term life insurance due to their lower risk of mortality. On the other hand, whole life insurance quotes are influenced by age and health as well, with healthier individuals receiving more favorable rates.

It's essential to assess your current health status and age to determine which type of insurance aligns best with your financial goals and coverage needs.

Impact of Coverage Duration

The duration of coverage is another crucial factor to consider when choosing between term and whole life insurance. Term life insurance offers coverage for a specific period, such as 10, 20, or 30 years, making it suitable for individuals who need coverage for a specific timeframe, like until their children are financially independent or a mortgage is paid off.

On the other hand, whole life insurance provides coverage for the insured's entire life, along with a cash value component that can serve as a savings or investment vehicle. Consider your long-term financial objectives and the duration of coverage you require to determine which type of insurance best meets your needs.

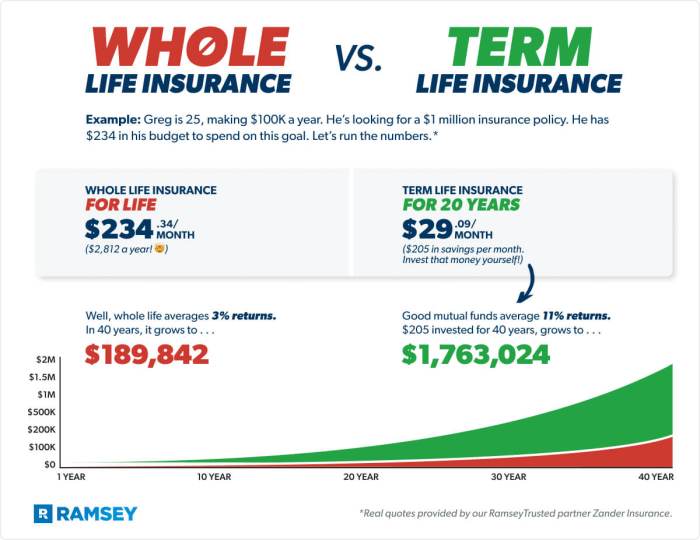

Cost Analysis

When comparing term life insurance quotes to whole life insurance quotes, it is crucial to consider the cost implications. The premiums for each type of insurance can vary significantly based on various factors such as age, coverage amount, and other individual circumstances

Understanding these cost differences can help you make an informed decision that aligns with your financial goals and needs.

Premium Variation Based on Age

The age at which you purchase life insurance can have a significant impact on the cost of premiums. Generally, younger individuals tend to pay lower premiums for both term and whole life insurance policies. This is because younger individuals are perceived to be lower risk for insurance companies.

As you age, the cost of premiums for both types of insurance is likely to increase. However, term life insurance premiums typically increase more sharply with age compared to whole life insurance.

Premium Variation Based on Coverage Amount

The coverage amount you choose also plays a crucial role in determining the cost of premiums for both term and whole life insurance. Higher coverage amounts typically result in higher premiums. With term life insurance, you have the flexibility to choose a coverage amount that aligns with your specific needs for a certain period.

On the other hand, whole life insurance provides a guaranteed death benefit regardless of the coverage amount, which can lead to higher premiums compared to term life insurance.

Long-Term Financial Implications

When considering the cost analysis between term and whole life insurance, it is essential to evaluate the long-term financial implications of each option. Term life insurance is generally more affordable initially, making it an attractive option for individuals looking for temporary coverage.

However, as you renew your term policy, the premiums may increase significantly, especially as you age. In contrast, whole life insurance offers lifetime coverage with fixed premiums, providing a sense of financial security and potential cash value accumulation over time.

While whole life insurance may be more expensive upfront, it can provide stability and financial benefits in the long run.

Suitability and Recommendations

When it comes to choosing between term life insurance and whole life insurance, the decision should be based on individual financial goals and needs. Each type of insurance offers different benefits and considerations that can impact the overall suitability for an individual.Term life insurance is often recommended for individuals who have specific financial obligations or dependents for a defined period.

It is a more affordable option compared to whole life insurance and can provide coverage during critical years when financial responsibilities are highest. Young families, individuals with outstanding debts, or those with limited budgets may find term life insurance to be a suitable choice.On the other hand, whole life insurance offers lifetime coverage with a cash value component that grows over time.

This type of insurance can be beneficial for individuals looking for long-term financial security, estate planning, or a guaranteed death benefit. Whole life insurance is often recommended for individuals who want coverage for their entire life and are willing to pay higher premiums for the added benefits.In some cases, a combination of both term life insurance and whole life insurance could be considered.

This strategy, known as laddering, involves purchasing a combination of policies to meet different financial needs at various stages of life. For example, individuals may start with a term life policy to cover immediate financial obligations and add a whole life policy later for long-term security and wealth accumulation.

Scenarios for Combination Insurance

When considering a combination of term life insurance and whole life insurance, individuals should evaluate their current financial situation, future goals, and risk tolerance. Here are some scenarios where a combination of both types of insurance could be beneficial:

- Young families: Starting with a term life policy to cover mortgage payments, education expenses, and other immediate needs, while adding a whole life policy for long-term financial security and estate planning.

- Business owners: Using term life insurance to protect business debts and liabilities, and whole life insurance to provide key person coverage or fund a buy-sell agreement.

- Risk-averse individuals: Opting for a mix of term and whole life insurance to balance cost-effective coverage during critical years and long-term financial protection.

Final Wrap-Up

Concluding our discussion on Term vs Whole Life Insurance Quotes: Which Is Better for You?, this section encapsulates the key points and leaves readers with a lasting impression of the topic, ensuring a thorough understanding and thoughtful reflection.

Expert Answers

What factors should individuals consider when choosing between term and whole life insurance?

Individuals should consider factors such as their financial goals, coverage needs, age, and health status to determine the most suitable type of insurance for their situation.

How do premiums vary based on age, coverage amount, and other factors?

Premiums for both term and whole life insurance are influenced by factors like age, coverage amount, health status, and the length of the policy. Younger individuals generally pay lower premiums compared to older individuals, and higher coverage amounts typically lead to higher premiums.

In what scenarios could a combination of both term and whole life insurance be considered?

Combining both types of insurance may be suitable for individuals who want coverage for different needs. For example, using term life insurance for temporary needs and whole life insurance for permanent needs can provide comprehensive coverage.